XRP Price Prediction: Will It Reach $3 Amid Bullish Technicals and Market Optimism?

#XRP

- XRP is trading near $3 with bullish technical indicators, including position above the 20-day moving average.

- Positive news on ETFs, regulatory easing, and cloud mining adoption supports upward price momentum.

- A break above the Bollinger Band upper resistance at $3.0943 could accelerate gains toward higher targets.

XRP Price Prediction

Technical Analysis: XRP Price Momentum

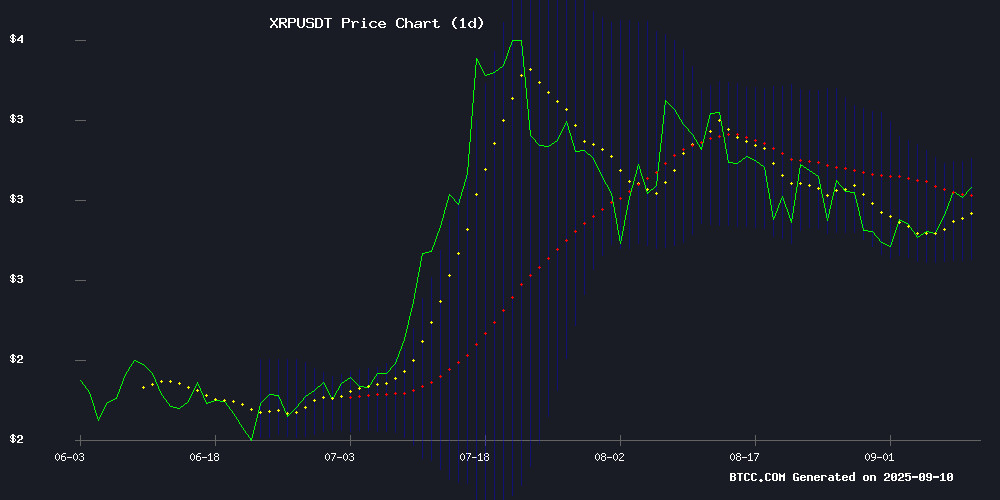

XRP is currently trading at $2.983, slightly above its 20-day moving average of $2.9015, indicating potential bullish momentum. The MACD reading shows a slight bearish crossover with the signal line at 0.1025 versus the MACD at 0.0783, suggesting some near-term consolidation. However, the price remains within the Bollinger Bands range of $2.7087 to $3.0943, with the current level approaching the upper band. According to BTCC financial analyst Ava, 'The technical setup suggests XRP is testing key resistance levels, and a break above $3.0943 could signal further upward movement.'

Market Sentiment: Bullish Catalysts for XRP

Recent news highlights several positive developments for XRP, including ETF speculation, regulatory clarity from the SEC, and expanded cloud mining offerings. Headlines such as 'XRP Price Set for Powerful Rally: $4.50 Target Comes Into Play' and 'XRP Stages a Strong Comeback' reflect growing optimism. BTCC financial analyst Ava notes, 'The combination of technical strength and favorable news FLOW creates a supportive environment for XRP, though the $3.50 resistance remains a key level to watch.'

Factors Influencing XRP's Price

XRP Price Set for Powerful Rally: $4.50 Target Comes Into Play

XRP has emerged from months of consolidation, with $3 now serving as a critical pivot level. The cryptocurrency's recent price action suggests a bullish breakout, supported by improving momentum indicators and higher intraday lows.

Market observers note that a confirmed daily close above $3.05 could trigger a rally toward $3.20-$3.30, with $3.40 as a stretch target. The $3 level has become a key support zone, while failure to hold $2.80 could signal a return to the $2.50 demand area.

Technical indicators reinforce the bullish case, with the Relative Strength Index (RSI) holding above 55 after forming higher lows in late August. This momentum shift suggests growing buying pressure as XRP tests resistance near $3.

XRP Price Prediction: $3.50 Resistance in Sight Amid Bullish Technicals

XRP shows renewed strength as it stabilizes near $3.02, with traders eyeing a potential rally toward the $3.50 resistance level. The token has rebounded from a six-week low of $2.75, breaking free from a symmetrical triangle pattern that constrained price action since late July.

Technical indicators now favor bullish momentum. The formation of a golden cross—where the 20 EMA surpasses the 50 EMA—signals a potential sustained uptrend. Momentum tools like the Bull Bear Power histogram and Parabolic SAR further confirm growing buying pressure.

Market sentiment has shifted from neutral to optimistic as XRP reclaims all major EMAs. Analysts suggest a confirmed breakout above current resistance could validate the bullish continuation pattern, with $3.50 emerging as the next key target.

Siton Mining Launches XRP Cloud Mining App to Democratize Digital Asset Participation

Siton Mining has disrupted traditional cryptocurrency mining models with its newly launched XRP Cloud Mining App. The platform eliminates hardware barriers and high energy costs, offering global users one-click access to cloud mining with daily real-time returns.

The app incorporates enterprise-grade security protocols including military-grade encryption, distributed architecture, and multi-layered risk control systems. A novel USD-pegged settlement mechanism provides stability against XRP's inherent market volatility, addressing a key concern for retail participants.

This innovation arrives as blockchain adoption accelerates globally, particularly in developing markets where capital-intensive mining operations remain inaccessible. Siton's solution could potentially onboard millions of new users to XRP's ecosystem while reshaping mining economics.

XRP Stages a Strong Comeback: Will September Outshine August 2025?

XRP, the native token of Ripple's payment network, has rebounded in September following an August sell-off. With a market cap of $176.33 billion and a 24-hour trading volume nearing $5.41 billion, the altcoin remains a focal point for traders navigating market volatility.

Currently trading at $2.95, XRP tests a critical resistance level at $2.9987. A breakout could propel prices toward $3.2000, while failure to hold support at $2.7889 may trigger a decline to $2.6000.

Technical indicators present conflicting signals: the Moving Average suggests bearish pressure at $3.0154, while the MACD's bullish crossover hints at upward momentum. Market participants weigh these mixed signals against broader crypto market trends.

XRP Nears $3 on ETF Hopes Amid XRPL Adoption Concerns

XRP surged to $3.04, a two-week high, fueled by speculation of a potential U.S. ETF approval as early as October. Institutional demand intensified, with CME futures contracts spiking 74% and aggregate open interest reaching 2.69 billion XRP ($7.91 billion).

Market optimism contrasts with lingering doubts about the XRP Ledger's adoption pace. Derivatives data shows balanced long-short positions, with futures trading at a 7% premium to spot—no signs of excessive leverage distorting the rally.

BAY Miner Expands Cloud Mining Offerings Amid XRP Regulatory Clarity

BAY Miner has introduced new cloud mining options designed to convert idle XRP holdings into USD-denominated income, insulating users from market volatility. The platform's contracts payout daily in fiat, providing predictable returns regardless of XRP price fluctuations.

This expansion follows a pivotal U.S. court ruling that affirmed XRP's non-security status on public exchanges, sparking renewed institutional interest. The decision propelled XRP past $3 recently as regulatory uncertainty dissipated.

The service employs multi-signature wallets and enterprise-grade encryption, operating under global compliance standards. Unlike traditional mining operations, BAY Miner's model offers transparent daily profit calculations deposited directly to user accounts.

SEC Eases Stance: Most Tokens Not Securities, Backs Crypto Super-Apps

The U.S. Securities and Exchange Commission (SEC) has pivoted from its aggressive enforcement strategy under new leadership. Chairman Paul Atkins declared an end to 'regulation by fear,' signaling a shift toward clearer, unified rules for digital assets. The agency now explicitly states that most tokens do not qualify as securities—a stark departure from its previous litigation-heavy approach that ensnared platforms like Coinbase and Ripple.

A sweeping regulatory framework is underway, designed to consolidate trading, lending, and staking under a single rulebook. This 'super-framework' could enable crypto platforms to emulate Asian-style super-apps, combining multiple financial services seamlessly. The move aims to provide market certainty while addressing longstanding industry complaints about arbitrary enforcement.

XRP Price Rally Faces Critical Test as Market Awaits Breakout

XRP's price action remains tightly coiled beneath a descending trendline, with traders anticipating a decisive move this week. The token has defended its $2.75-$2.80 support zone despite waning bullish momentum since July. A clean break above resistance could propel XRP toward $3.35—a level last seen during the July rally.

Market participants are divided on sustainability. While RSI indicators show recovering strength, the token faces headwinds from exhausted retail buyers. Institutional interest persists, fueled by XRP's cross-border payment utility and growing liquidity across major exchanges.

Technical charts suggest a make-or-break scenario. Failure to hold current supports may trigger a retracement, whereas successful consolidation could set the stage for a retest of the $3.63 yearly high. The coming days will reveal whether this is accumulation before liftoff—or distribution before retreat.

XRP Price Surges Above $3 as Bullish Momentum Builds

Ripple's XRP broke through the $3.00 psychological barrier, trading at $3.02 with a 0.24% gain in the past 24 hours. Technical indicators point to a potential rally toward the $3.55 resistance level, with the RSI at 55.65 suggesting room for further upside.

Binance spot markets recorded $273.7 million in XRP trading volume, reflecting strong institutional and retail participation. The token maintains a bullish posture above all key moving averages, including the 200-day SMA at $2.49.

Absent major fundamental catalysts, XRP's price action mirrors broader crypto market dynamics. The consolidation above $3.00 demonstrates sustained confidence in the asset's long-term trajectory.

Will XRP Price Hit 3?

Based on current technical indicators and market sentiment, XRP has a strong chance of reaching $3 in the near term. The price is already at $2.983, just below this psychological level, and bullish news flow around ETFs, regulatory clarity, and adoption supports upward momentum. However, as BTCC financial analyst Ava highlights, 'Traders should monitor the $3.0943 Bollinger Band upper resistance, as a break above could confirm the rally.' Below is a summary of key levels:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $2.983 | Near $3 resistance |

| 20-Day MA | $2.9015 | Support level |

| Bollinger Upper | $3.0943 | Key breakout point |